Mergers and Acquisitions and the Transitions that Can Cause Conflict

/There’s at least a 34% chance that an investment in an organization will be adversely affected by destructive conflict within the team. The statistics – and stakes – can go even higher when the investment is in the form of a merger or acquisition.

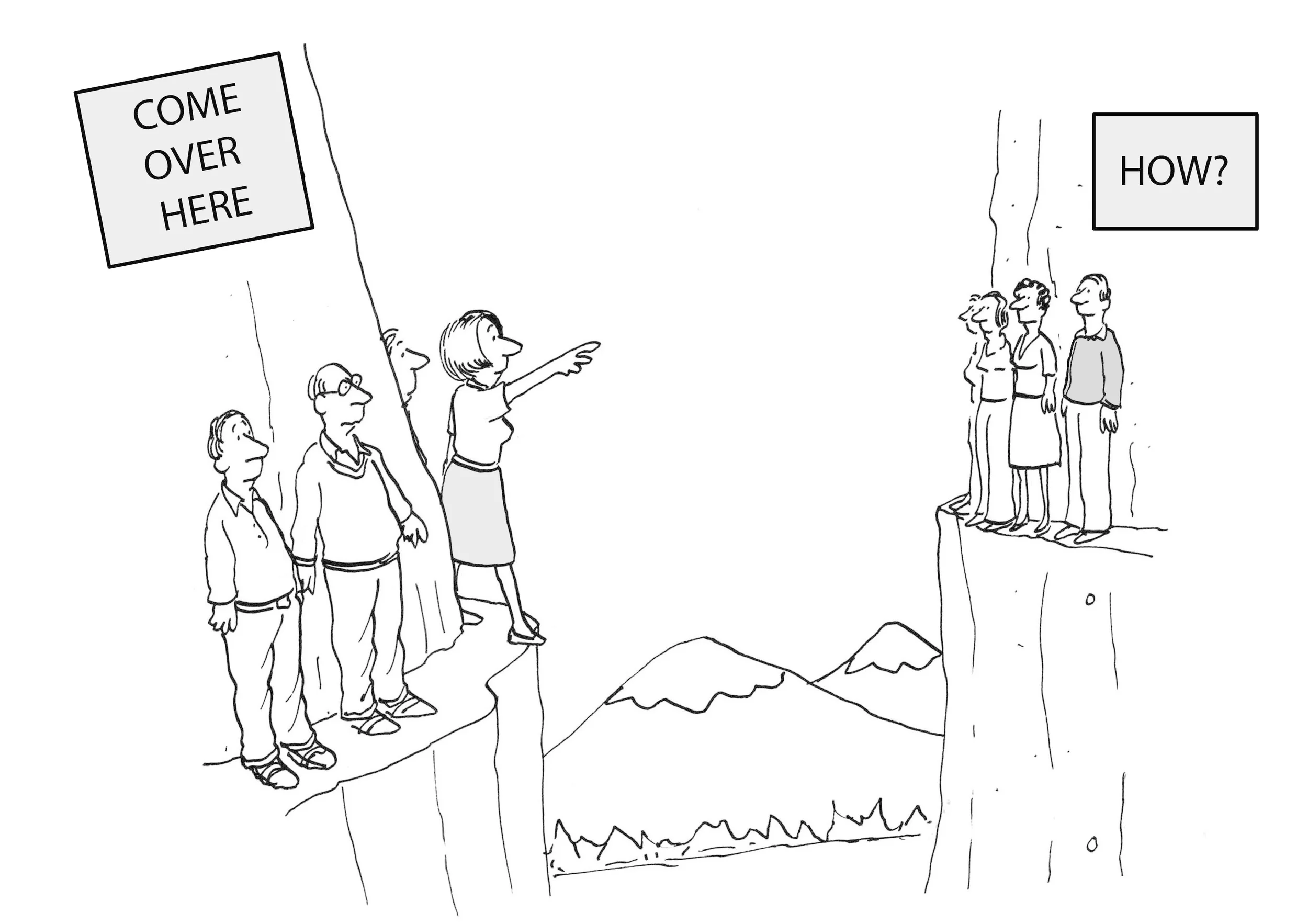

The human aspects of post-merger implementation of M&A deals have been studied thoroughly in recent years, and what they find in a large number of cases is that the merger, a good match on paper, fails in the transition process. Many companies focus on the financial and business systems transition, but don’t pay attention to the human factors until it’s too late. Cultures clash, employees leave, production declines, shareholders are unhappy, things fall apart. This has even been dubbed a “merger syndrome.” A study by KPMG found that “83% of all mergers and acquisitions (M&As) failed to produce any benefit for the shareholders.” The overwhelming cause for failure that was reported?

Read More

When we join a company, partnership or team, our expectation is that everyone involved will exhibit professional behavior toward us and each other. Instead, it’s highly possible that we may become one of the more than 60 million adults in the United States who are affected in some way by bullying behavior at work.

What kind of behaviors are we talking about? Our definition is any interpersonal behavior that causes emotional distress in others sufficient enough to impede their productivity or disrupt organizational functioning. It isn’t just a personality conflict — it’s a chronic pattern of disrespectful behavior.